China’s Influence in Mexico and Central America:

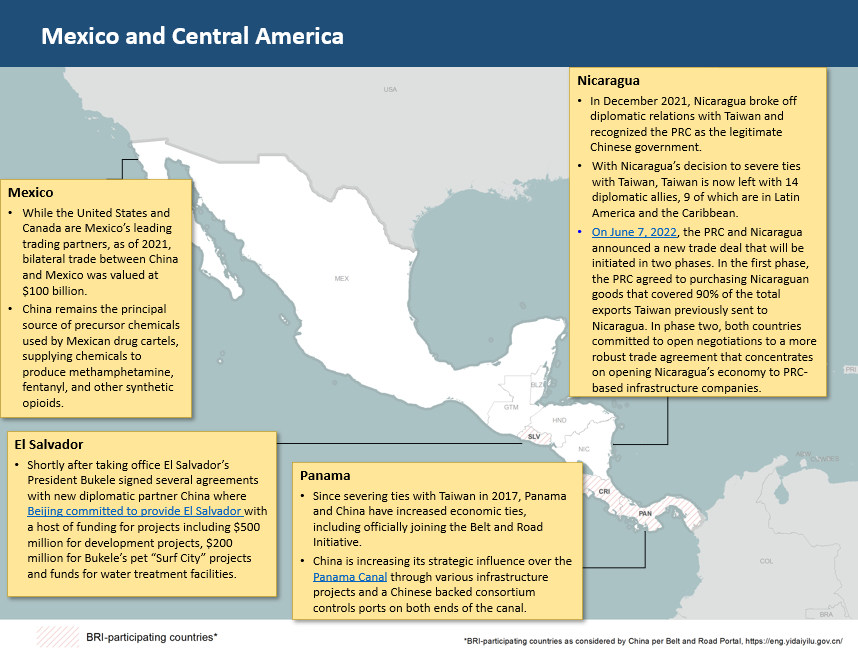

Despite efforts by past Mexican administrations to strengthen economic ties with China, the U.S. remains Mexico’s top trading partner and foreign investor. The recent signing of the USMCA trade deal further cemented Mexico’s commercial ties to North America. Nonetheless, Chinese companies continue to invest in strategically important sectors including energy and telecommunications.

In Central America, China’s recent engagement resulted in Panama and El Salvador breaking diplomatic ties with Taiwan. Belize, Honduras, and Guatemala are Taiwan’s remaining allies in Central America. However, we can expect China to continue its efforts to further reduce Taiwan’s ties to the region.

Despite the failure of several infrastructure projects, China continues to push more projects aimed at buying political influence through corruption and other illicit means. China’s engagement also threatens to weaken the region’s already fragile democratic institutions.

China’s Investment’s in Mexico and Central America:

As of 2022, Panama has received $2.5 billion in investments from China since 2005, the largest investment in the region, with additional investments following Panama’s establishment of official ties with the PRC in 2017.

Since 2005 China has invested $4.1 billion into Mexico, making China Mexico’s ninth largest investor.

- During 2021, Chinese and Hong Kong based companies invested $606.3 million in Mexico – up 76% from 2020.

- $2.26 billion of these investments were in Mexico’s energy sector with the rest divided among the logistics, metals and transports sectors.

Other Central American countries have also received substantial investments from China including $700 million in Guatemala’s technology sector and $810 million in Costa Rica’s transport, entertainment and technology sectors.

China’s Investment’s in Mexico and Panama’s Telecommunications:

In 2017, China’s Huawei landed a contract to provide the equipment for Mexico’s communications network, but was blocked from supporting the system’s “core” and sites near the U.S. border.

- However, in 2018 Huawei began working on three tech infrastructure projects in three northern Mexican cities that were originally meant to go to Nokia, raising concerns about the close proximity of Huawei’s equipment’s to the U.S. border.

AT&T acquired two Mexican telecom companies and removed Huawei equipment from sensitive parts of its 4G network. Concerns remain about AT&T and Mexico’s ability to push back on Huawei during the eventual rollout of a 5G network.

In Panama, Huawei has made the Colon Free Trade Zone a regional hub for the distribution of its electronic systems and installed its intrusive “Safe City Technology” that includes facial recognition cameras used to deter crime in the area.

- This technology is integrated into China’s Orwellian surveillance system used to monitor citizens and specifically target disadvantaged minority populations such as Muslim Uyghurs – raising concerns about the potential for the abuse of the technology in other countries where it is implemented, and ethical concerns for interactions with the companies involved in creating these technologies for China’s security agencies.

China Projects in Mexico and Central America:

An estimated $1.2 billion joint effort project, Housfan Industrial Park, between 20 Chinese businesses and their Mexican counterparts in Nuevo Leon has entered the first phase of completion and rolling development is underway. This project is one of 18 deals in Nuevo Leon last year, compared with seven in 2020 and just two between 2015 and 2018.

In 2020, the Chinese Development Bank announced it would invest $600 million for the construction of the Dos Bocas oil refinery in Mexico, which would be the country’s largest state-controlled refinery.

In 2020, a Mexican consortium announced its partnership with the China Communications Construction Company (CCCC) to build the Mayan Train Project. The CCCC was blacklisted by the World Bank in 2011 for fraudulent practices and has been involved with several irregularities in its projects throughout the region.

In 2013 a Hong Kong-based developer announced a deal with Nicaragua’s Sandinista government for a $50 billion canal to compete with the Panama Canal.

- While the project has stalled, the U.S. Treasury alleged that the Ortega family uses the proposed canal to launder money and cited the project in its announcement of sanctions on Ortega family members. The project also resulted in a land concession along the proposed canal route for the Chinese company.

In late 2018, the PRC initiated an array of projects in El Salvador that established six special economic zones (SEZs) – encircling the trade epicenter, La Union. These trade zones cover 14 percent of the national territory and excludes American and European businesses, investments, and trade.

In 2019, Chinese-Salvadoran investor Bo Yang purchased land for a $3 billion, 1700 square mile expansion of a port called La Union located in the Gulf of Fonseca, which borders El Salvador, Honduras, and Nicaragua.

- Mr. Yang offered residents of Perico Island $7,000 each to relocate so that he could complete the expansion. Mr. Yang has been promoting deals for China in El Salvador for 30 years. The State Department labeled former mayor of La Union Ezequiel Milla Guerra “corrupt and undemocratic” for engaging in “significant corruption by abusing his authority” as mayor in the sale of Perico Island to agents of Mr. Yang “in exchange for personal benefit”.

China Projects in Panama:

Since establishing relations with China in 2017, Panama has signed over two dozen agreements with Chinese companies in its infrastructure sector, including ports and energy, many of which are alleged to have been made under questionable circumstances.

- A $5.5 billion, 450km high-speed rail project, connecting Panama City to Chiriqui province.

- Construction of a port for cruise ships, a bridge, and a convention center around the Panama Canal.

- Chinese group Shanghai Gorgeous is investing $900 million to build a second, 441 MW natural gas fired electricity generation facility at the Atlantic exit of the Panama Canal.

- China also almost succeeded in reaching a deal to build its new embassy at the entrance of the Panama Canal, but the deal was cancelled following pressure from the U.S.

Advancements by Chinese state-owned shipping companies, investment groups, and construction companies in projects around the Panama Canal threaten to further expand China’s influence over the canal’s operations at the expense of Panama’s sovereignty and democratic institutions.

China’s Projects in Costa Rica:

Despite a promising start to the relationship, since 2008, multiple PRC-led projects have been halted or postponed due to irregularities, malpractice, and corruption.

- In 2013, a PRC-backed refinery modernization project was halted when the company conducting the feasibility study was found to have ties to the lead contractor, creating a conflict of interest.

- A PRC-backed highway improvement project was blocked by the Costa Rican Congress when over inflated project costs and interest rates, unacceptable arbitration mechanisms and the discovery that the parent of the company doing the work had been barred from World Bank projects over corruption charges.

The PRC telecommunications firm Huawei controls 37% of the cellular market in Costa Rica.

China’s “Soft Power” Initiatives in Mexico and Central America:

As of April 2022, Chinese Confucius Institutes are present in 23 Latin American and Caribbean countries.

In January 2018, a delegation from a CCTV subsidiary made deals to air a Spanish-dubbed version of a Chinese-produced drama on state TV of Latin American countries including Mexico. Investors believed to have close ties to the CCP-friendly Phoenix TV moved to purchase a radio station in Mexico near the border with the United States, raising suspicions that it would be used to broadcast pro-Beijing content to Chinese speakers in southern California.

The China-CELAC (Comunidad de Estados Latinoamericanos y Caribenos) Forum was established in 2014 aimed at “promoting the development of the comprehensive partnership” between China and Latin American countries.

- The China-CELAC Forum started the “China-LAC Young Scientists Exchange Program”, a ten-year training program for 1,000 young leaders from China and Latin America, to promote a long-term scientific and technological partnership between Latin America and China.

*Last Updated: 10/25/2022

###